Astral Pay - Help:

When Stripe Fees are deducted from your payments, the Fees are posted to the account specified in the Fees Account within the Astral Pay Setup. The account can be either a G/L Account or a Vendor Account.

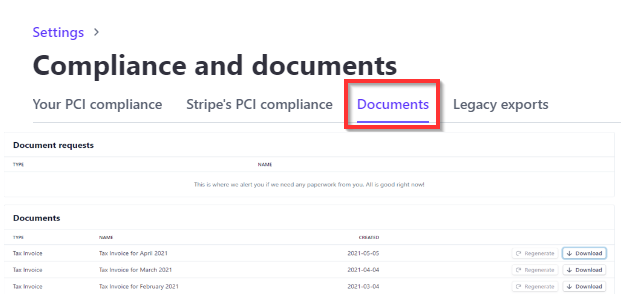

Stripe will provide a ‘Tax Invoice’ for the month. These can be downloaded from the Stripe Portal.

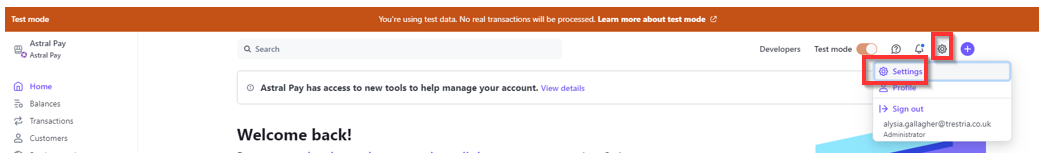

Figure 1 | Stripe Portal

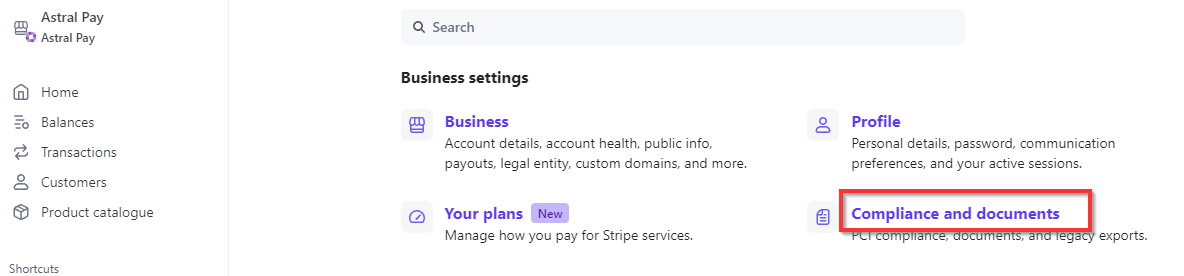

Figure 2 | Stripe Portal Documents

Figure 3 | Stripe Portal Documents

Figure 4 | Downloaded Stripe Invoice

Therefore, the fees that are recorded when the ‘Balance Transaction’ is posted is a payment against a future Vendor invoice. We would therefore recommend that the Astral Pay ‘Fees Account Type’ be set as ‘Vendor’. Then, the posting of the Invoice will allow you to correctly record the VAT or other taxes, and VAT and taxes will not need to be recorded within each transaction posting.