Astral Recurring Invoices - Help:

To avoid confusion between Recurring Sales Invoice Templates and Sales Invoices, we can start with explaining how “Deferred Entries” can work on Purchase Invoices.

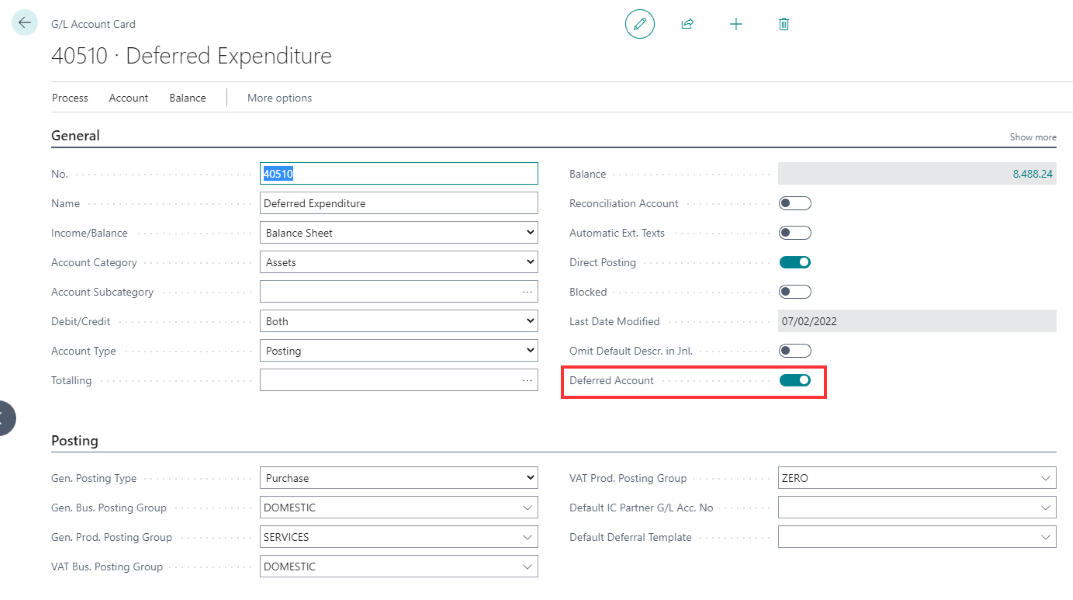

Firstly, you will need a Balance Sheet code setup in the Chart of Accounts that you can use for Deferred Expenditure. For example:

Figure 1 | Deferred Expenditure

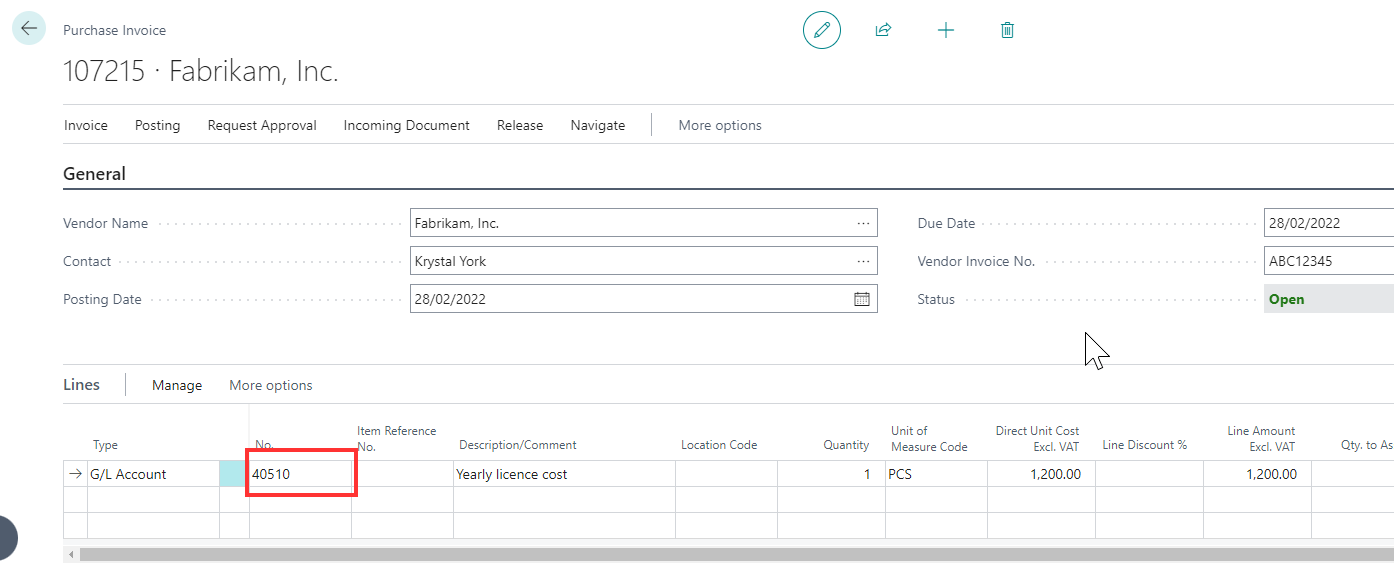

Then, on a Purchase Invoice, enter the 'No.' field as the 'Deferred Expenditure' account.

Figure 2 | Purchase Invoice

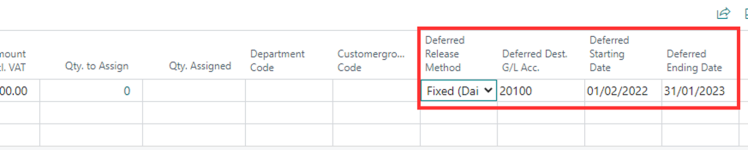

As an account has been specified that is flagged as being a “Deferred Account”, the 'Deferred Release Method', 'Deferred Dest. G/L Acc.', 'Deferred Starting Date' and 'Deferred Ending Date' fields must be specified.

Figure 3 | Deferred Fields

On posting the Purchase Invoice, the full line value is posted to the “Deferred Expenditure” account, and an entry is made in to the “Deferred Entries” table for later release.

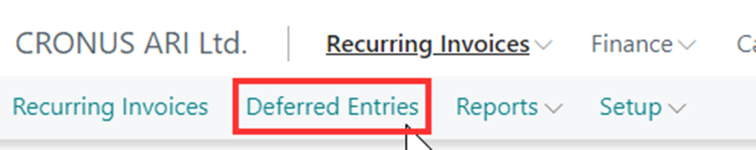

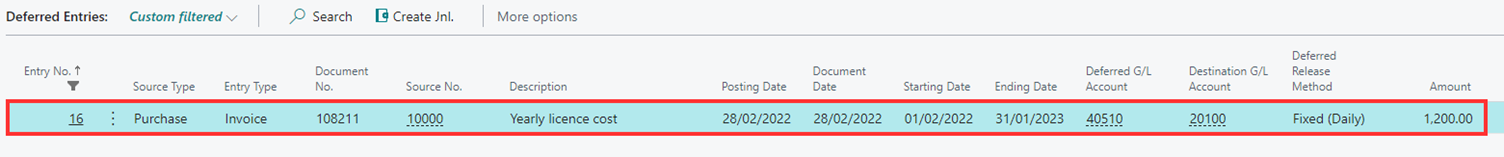

From the main 'Recurring Invoices' drop-down menu, select 'Deferred Entries' to see the new entry.

Figure 4 | Deferred Entries

The Deferred Entry will show as follows:

Figure 5 | Deferred Entry Screen

Releasing the entry is discussed later in a further section.