Astral Recurring Invoices - Help:

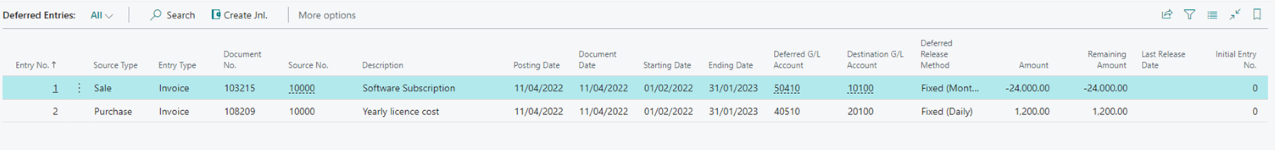

After posting Sales Invoices and Purchase Invoices that use G/L Accounts enabled as “Deferred Accounts”, the Deferred Entries table will show the initial entries.

Figure 1 | Deferred Entries

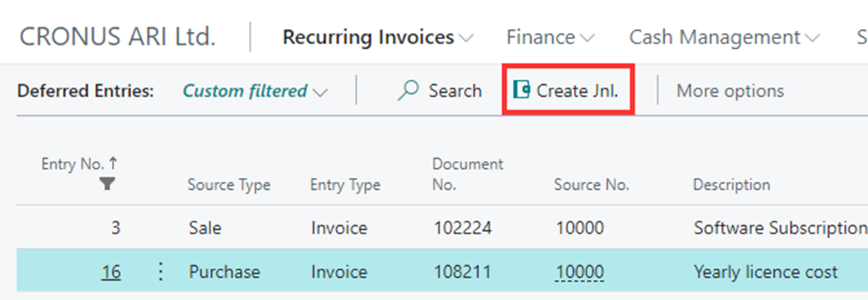

At the end of each month, use the 'Create Jnl.' action to create a journal to release the entries to the Income Statement.

Figure 2 | Create Journal

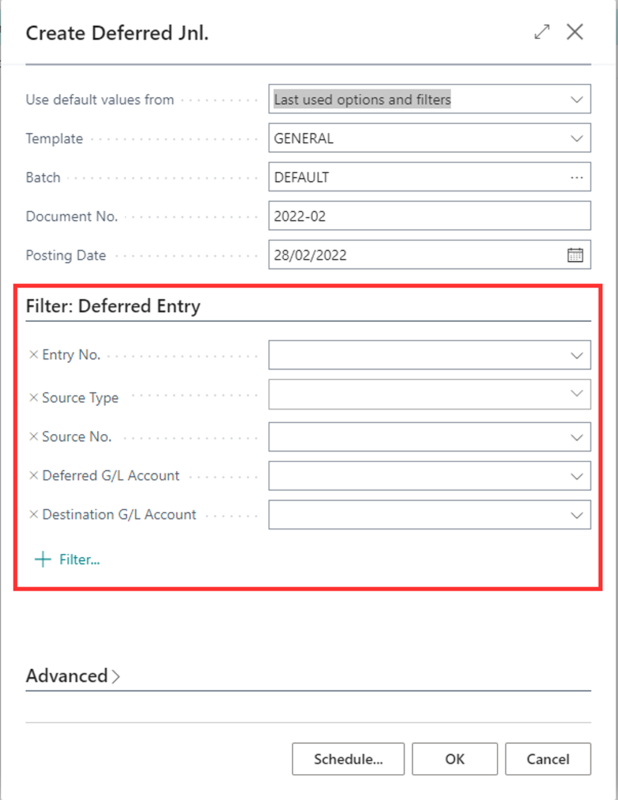

The 'Create Deferred Jnl.' Request page will open.

Figure 3 | Create Deferred Journal Page

The top section is required for creating the journal and calculating the journal line amounts. The 'Filter: Deferred Entry' section can be used if required to limit the entries that are included in the journal. For example, you may wish to create one journal for Sales and another for Purchases. Also, within sales, you may wish to include only the entries that have been deferred to a specific 'Deferred G/L Account'.

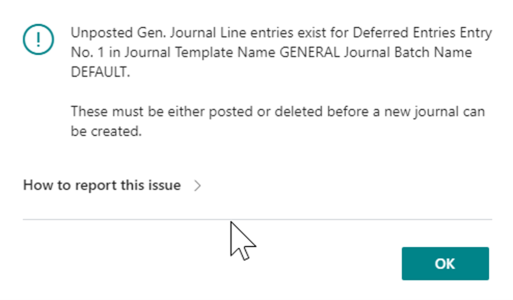

NOTE: Before generating each journal line, the process will first check to make sure that there are no unposted journal lines relating to the Deferred Entry to be released. If an unposted journal line exists, the following message will be displayed:

Figure 4 | Message Error

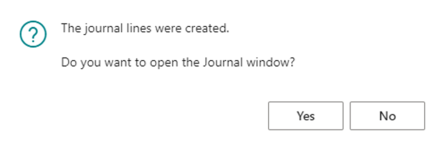

Once the journal has been created, the following message will be displayed:

Figure 5 | Message

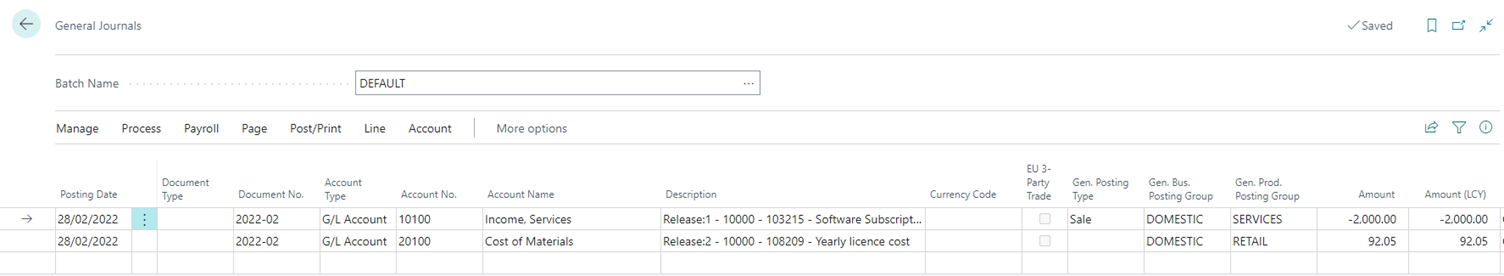

Clicking 'Yes' will open the journal allowing it to be posted.

Figure 6 | Journal Entries