Astral GoCardless - Help:

If GoCardless charge VAT on their fees in your country we would suggest that rather than posting the Fees to a G/L Account in the Income Statement, that you instead post the Fees deducted from each payment to a “GoCardless” Vendor Account. Then, at the end of each month, GoCardless will provide a monthly VAT Invoice, which would account for the Net Fees and VAT. The various payments throughout the month would then be allocated to the Invoice as a series of part payments.

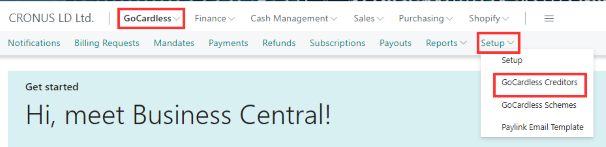

The method for posting the Fees is covered in the Assisted Application Setup Wizard. Alternatively, open the 'GoCardless Creditors' list page.

Figure 1 | Business Central GoCardless Creditors

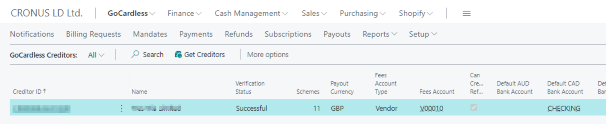

On the 'GoCardless Creditors' list page, click the 'Creditor ID' field to open the 'GoCardless Creditor' card page.

Figure 2 | GoCardless Creditors Page

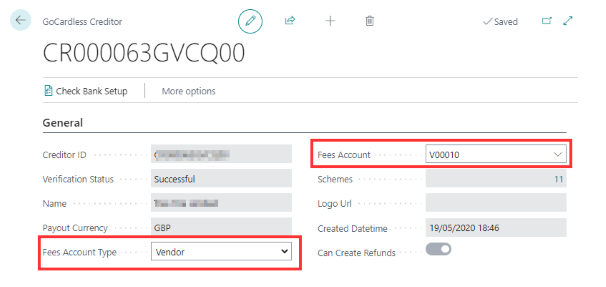

And choose values for the 'Fees Account Type' and 'Fees Account' accordingly.

Figure 3 | GoCardless Creditor Card